As a parent carer of disabled children I feel that we are deeply undervalued. Well carers in general, but I would like to focus on being a parent carer of disabled children. Those of us who do not go out to work, and earn a certain amount, seem to be considered that we are not doing enough.

This post was actually triggered by a comment about whether I would like to come off benefits at some point. You see the thing is I am a parent carer as I have 2 disabled sons (only one of which I receive carers allowance for). Some would argue that they are my children and I should not receive money for them (see my previous post on Pinkoddy about why I feel it is right for people to claim disability living allowance for their children). But I want to do whatever I feel will help them most in life.

You can claim Carers Allowance as a Parent Carer

Carers allowance is paid to those (including if you are a parent carer) who are looking after someone who receives:

- Attendance Allowance

- Disability Living Allowance – the middle or highest care rate

- Constant Attendance Allowance at or above the normal maximum rate with an Industrial Injuries Disablement Benefit

- Constant Attendance Allowance at the basic (full day) rate with a War Disablement Pension

- Armed Forces Independence Payment (AFIP)

- Personal Independence Payment daily living component

The parent carer (but you don’t have to be the parent) must be over 16 years old and care for at least 35 hours a week, for which they are given an allowance of £59.75. Ironically the comment was made after we had been discussing the fact that self-employed people should be earning at least the minimum wage, but this equates to less than £1.71 an hour! Well below minimum wage. Of course after putting your career on hold if you are lucky enough that child will become independent enough to leave home and make a life for themselves. But what of you then – too old to retrain and lacking in experience to work other areas, the whole time you have been scrapping by on minimum money.

Now I know that you can be a parent carer and work around these hours (say when a child is at school). I feel that you are lucky if as are a parent carer you have found a good enough employers to be flexible with time off, or have a child who, you feel, does not need you to be readily available. Obviously some people HAVE to work, as Carers Allowance is not enough.

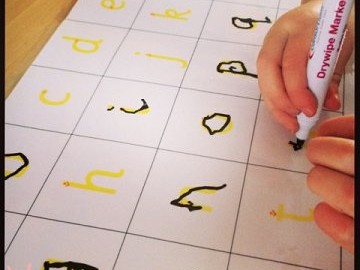

For those of us who feel that we need to be (and I am well aware that parents of non-disabled children may feel this too) available for our children – for IEP meetings, annual reviews, because your child is not coping/need to go to the hospital/has fallen asleep – whatever the reason to be taken out of school at short notice – then this small amount of money helps make that a possible option. Whilst they are at school we may also be doing things to help them when they are home again (maybe setting up something to help them develop socially, emotionally, their language, fine motor skills etc, or arranging appointments, going through paperwork, washing their wet bedding – I am sure the list (and seriousness) could go on and on.

And of course there’s all the things that as a parent carer you have to do, above and beyond what you would do for a non-disabled child, for the 35 hours that you are with them. The one thing I am pleased about is that to receive carers allowance you do not have to justify what you do, you just have to show that the person you are caring for has a need to be cared for.

And yes I would like not to have to feel like the best situation is for me to claim, I would love that my son had no additional needs.

Do you feel that you are a parent carer who is undervalued? What kind of things do you feel are beyond the norm that you have to do in your role as a parent carer? What would you say to someone who tried to undervalue what you do?